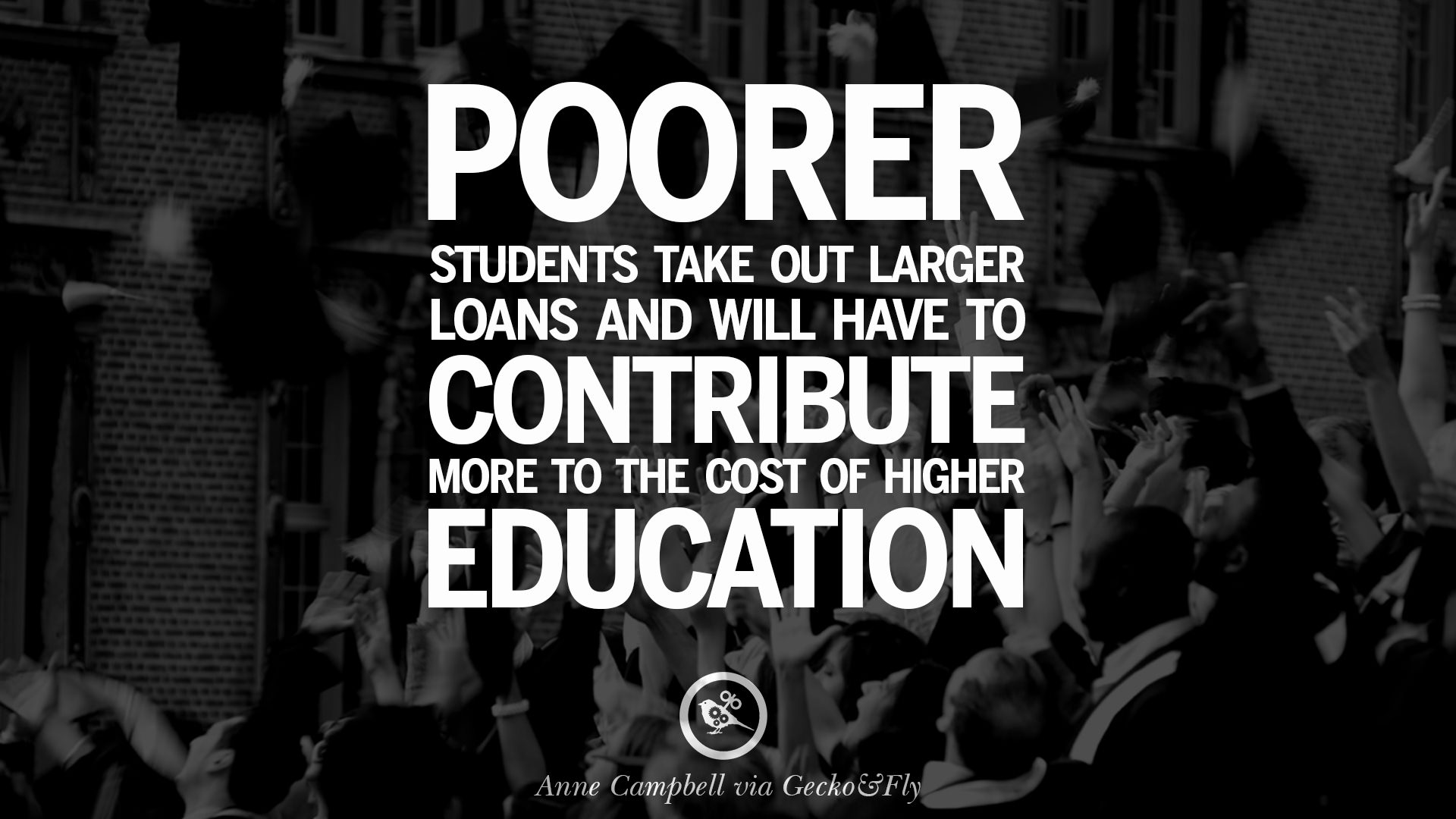

Americans have over up $1.6 Trillion in student loan debt, according to the Federal Reserve Board. By 2023, 40% of borrowers who entered school in 2003-2004 will have defaulted.

buy ivermectin online https://resmedfoundation.org/testing/php/ivermectin.html no prescription pharmacy

The average household debt in America as of 2017 stood at $17,000 in credit cards, $30,000 in auto loans, $51,000 in Student loans, and $182,000 in Home loans. A grand total equals $280,000. As of 2018, the debt decreased to 1,000.

buy bimatoprost online https://www.islington-chiropractic.co.uk/wp-content/uploads/2025/01/png/bimatoprost.html no prescription pharmacy

If you don’t believe the stats, start asking the person to the left and right of you.

buy deltasone online https://www.islington-chiropractic.co.uk/wp-content/uploads/2025/01/png/deltasone.html no prescription pharmacy

Facebook Comments