The Best Non Get Rich Quick Scheme

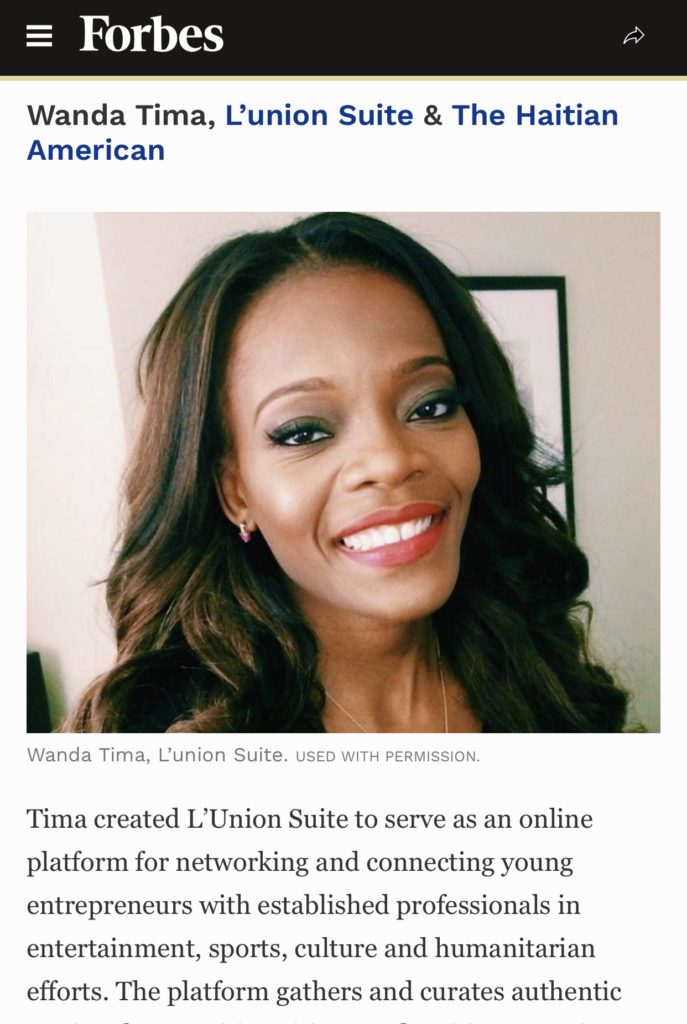

Written by Lawrence Gonzalez, LS Financial Literacy Blogger

We are starting something a bit new here on Lunionsuite.com.

Our goal is to drop Financial literacy tips so that you can think and grown richer than ever. Here’s a breakdown of the average retirement savings of U.S. families at every age:

- Between 32 and 37: $31,644

- Between 38 and 43: $67,270

- Between 44 and 49: $81,347

- Between 50 and 55: $124,831

- Between 56 and 61: $163,577

Information is accessible such as Mega Wealth secrets for FREE. Investing early does make a huge difference. With just $30,000, or about $3,000 annually for 10 years with an average diversified investments, you can have at least $1,000,000.

Waiting until your 30s, 40s, and 50s will cost you more. “Savvy investors” understand the benefits of starting early and taking advantage of the potential gains from compound interest.

You can do whatever you want with your money. However, if you look back at that W2 and can’t remember where the money went; you might want to rethink the strategy. Make the most of your dollars or not, the choices are endless.

Most people ask, what if you die before then? Answer, “leave it for your family”.

Reverse question, “Well person, what if you live until 88?”

Saving at 20+

Saving at 20+

“Start saving early, when time and compounding interest are working in your favor. That’s because whatever you put away at 21 is going to grow exponentially. And the sooner you begin, the more time you’re giving it to grow.Put simply, saving early is the smartest money “hack” you can do in your life.

Make it hurt early and you won’t notice the pinch later. At the very least you will have the $1M for retirement with less monthly burden with any other decade. Beats paying $800 in your 40s.

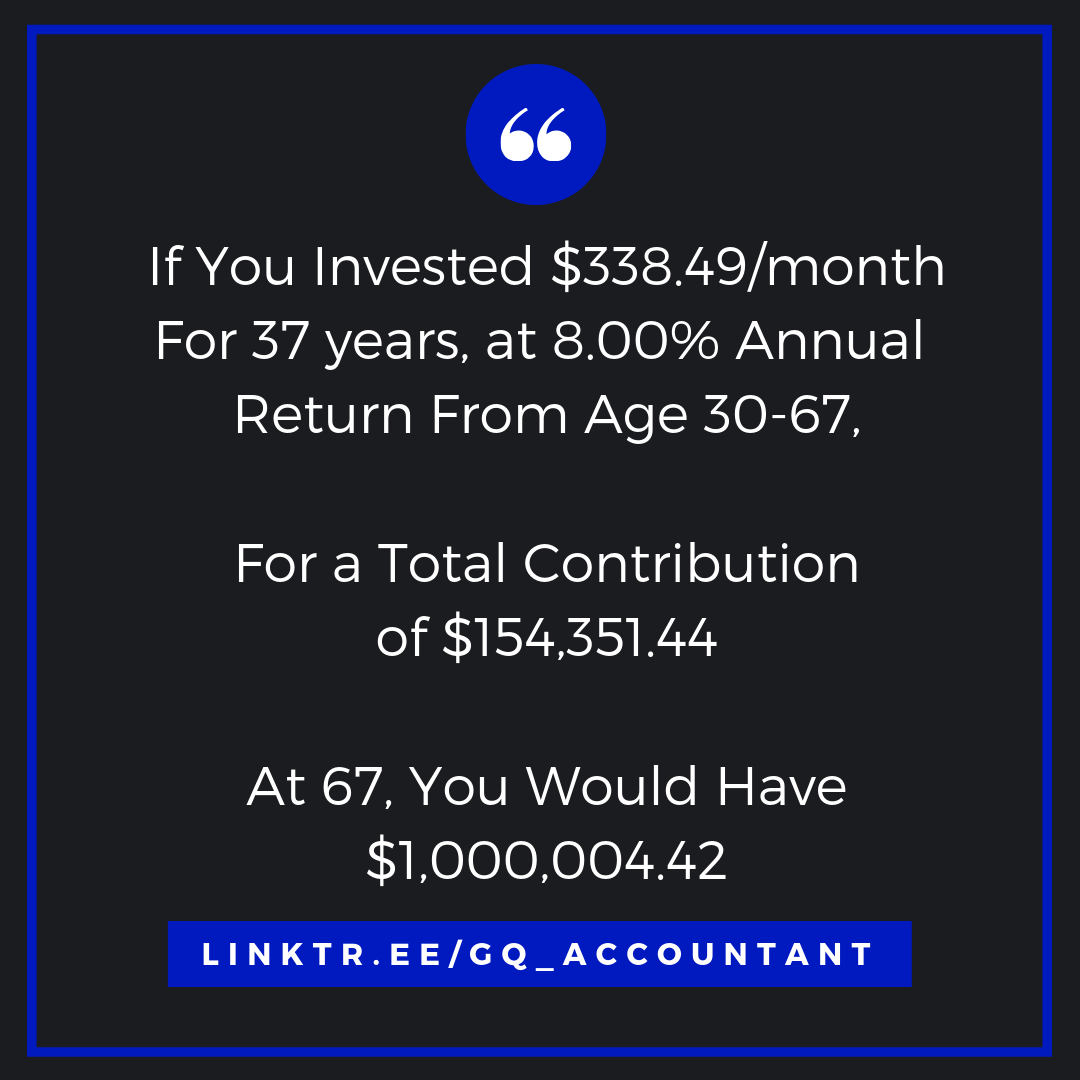

Saving at 30+

Saving at 30+

In your 20s, funding your 401(k) might have sounded like a good goal … for your 30s. Now that your 30s are here, you may be nervously noticing the countless articles on the virtues of investing in your 20s. Arielle O’Shea, January 2019

Waiting to invest in your 30s vs 20s is an increase 137%. If you don’t think you have $150 per month in your 20s; do you think you can cough up the extra $190 per month. That’s $4,080 per year for 37 years. That’s a #TravelNoire feature every year. Ok so you put it off til the 40s…

Saving at 40+

Saving at 40+

Waiting to invest in your 40s vs 20s is an increase 440%.

If you don’t think you have $150 per month in your 20s; do you think you can cough up $801 per month. That’s $9,600 per year for 27 years.

40s are rough, deep into the career, scope creep, mortgage, parent’s retirement, and kids… I can see why people park their cars and stay in the driveway.

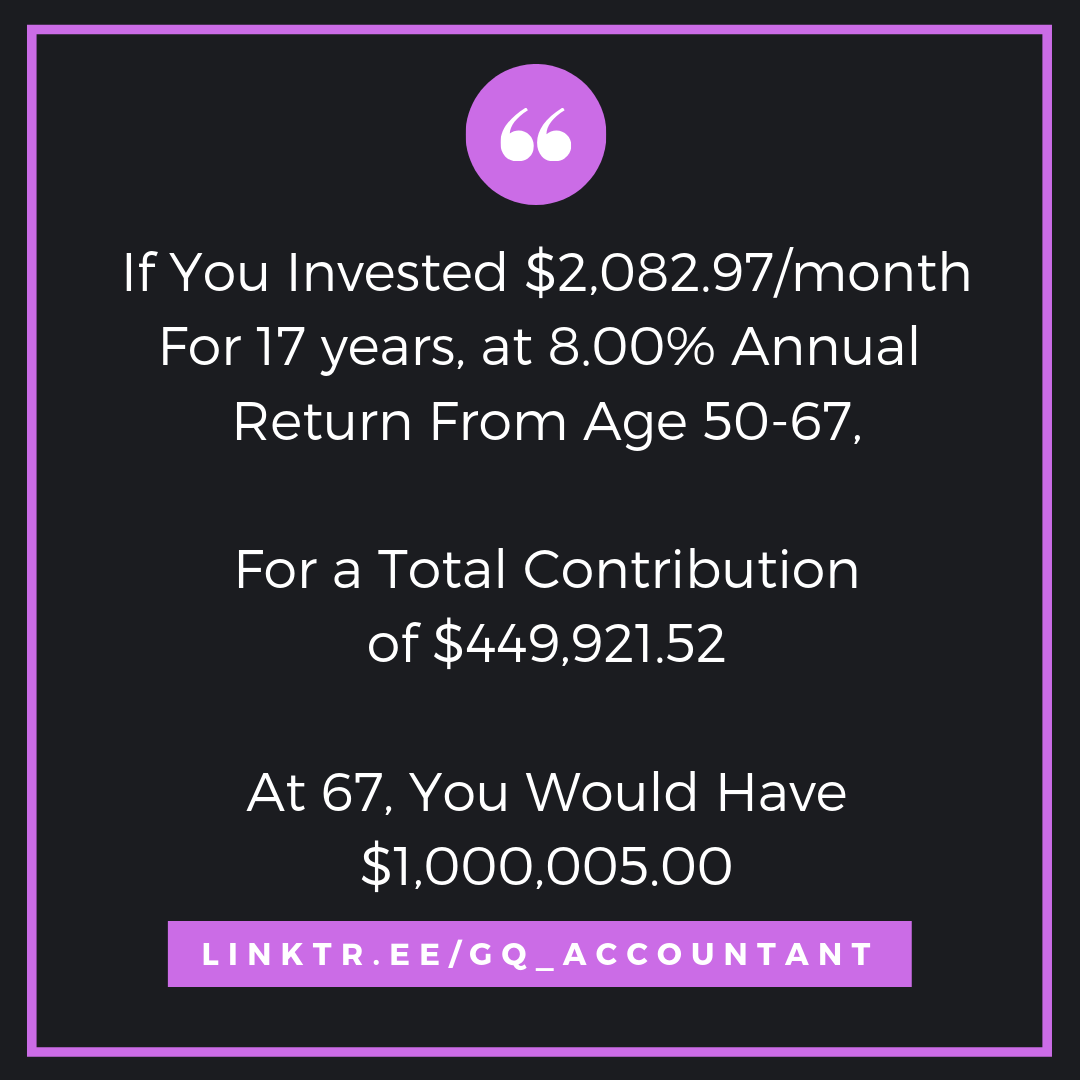

Saving at 50+

Saving at 50+

This is where people make the worst mistakes with money.

Desperation is a gateway to scams, quick fixes, and terrible last minute ideas. Insurance, Credit cards, Housing, personal loans, business ventures, and even taking money from the 401k or the kids’ college savings.

I’ve seen people take out the equity on their homes just to stay afloat for a little longer. This is when you start saying “I wish I saved and invested early”.

Money Stress

Nearly 50% of households have nothing saved for retirement, according to the Economic Policy Institute. Households between ages 50 and 55 have more — their the median retirement account hovers somewhere near $8,000. For households between ages 56 and 61, it’s over twice that, at $17,000.

Saving at 60+

Well the game has wrapped up. Count the chips and the blessings. It isn’t all doom and gloom. You will simply have to adjust.

Well the game has wrapped up. Count the chips and the blessings. It isn’t all doom and gloom. You will simply have to adjust.

Great family dynamics mean you can still offer your kids, a rent free location so they can save up. They can pay the property taxes. You can also assist with daycare cost. You live you learn and you get golden.

The game can still pan out with pensions, social security, and etc… Just laugh at the young folks blowing their money while missing out that social security is depleting. Here’s a nifty article on how to prepare as a family, the Plan.

The Wrap Up:

Bonus (for those who read all the way to the end) – You can save even more with this strategy. Just $30k transforms into a clean $1 Million. How Sway?